Controllables: 03.30.25

As mentioned in our previous Market Alert, the recent market volatility was anticipated. In light of the recent price drops, we are adjusting our recommended allocations. Below are the broad changes we suggest, which may vary slightly based on your personal situation:

Adopt a more Aggressive Portfolio Allocation Strategy emphasizing greater equity exposure and diversification

US Equity: Enhance diversification

Add S&P 500 Equal Weight ETF and US S&P 400 ETF (Mid Cap Equity exposure).

Reduce US Large Cap Value exposure to include a blend of growth and value holdings.

Decrease Small Cap exposure, particularly Small Cap Value, and balance it by adding a mix of growth and value securities

International Developed Markets

Shift from primarily International Large Cap Value exposure to investments with higher dividend yields in International Developed Markets.

Add Emerging Markets exposure to capitalize on higher growth rates.

Incorporate Alternative Investments

Specifically, Infrastructure investments and an Absolute Return fund, which have remained stable during the stock market downturn.

Exercise Caution with Fixed Income Security Selection

Prefer shorter duration high-quality government issues and floating rate senior secured bank loans.

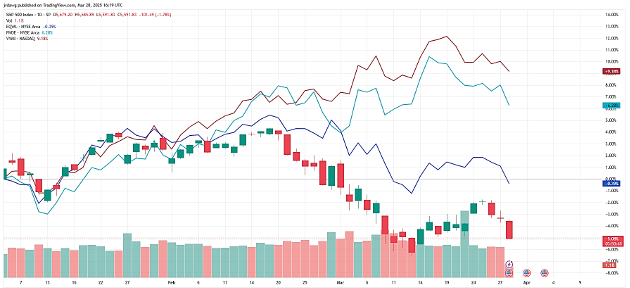

The first chart below compares the year-to-date (YTD) performance of the S&P 500 with the S&P 500 Equal Weight (EQWL), International Developed Market High Dividend Yield (VYMI), and Emerging Markets (FNDE)

All 3 investments - EQWL, VYMI, and FNDE – have outperformed the S&P 500 this year, by substantial margins.

The trend established this year is likely to continue given the more compelling valuations abroad.

The second chart compares YTD returns for the S&P 500 with our Infrastructure investment and Absolute Return Fund.

Both funds have outperformed the benchmark index this year with significantly lower volatility

Disclosure:

The information provided is for informational purposes only and does not constitute investment advice. The recommendations and strategies mentioned may not be suitable for all investors. Each investor needs to review an investment strategy for their own particular situation before making any investment decision. Past performance is not indicative of future results. All investments involve risk, including the loss of principal.